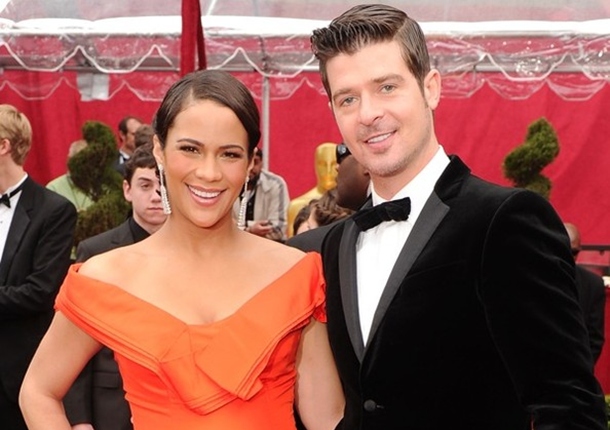

The IRS has been celebrity head hunting and power couple Robin Thicke and his wife Paula Patton are the tax collector’s latest victims.

According to the Detroit news, The R&B crooner and his actress wife was hit with a tax lien for $492,583.

Filed at the LA County Recorder’s Office, a spokesperson released at statement on behalf of both parties, insisting they were not aware of the monies owed but plan to take care of it urgently.

“They were just made aware of the issue and it is being taken care of immediately,” says the rep.

We’re sure with their success in music and films, this bill will be easily settled.

Robin Thicke and Paula Patton have recently found themselves in hot water with the IRS. The couple reportedly owes a whopping $491,000 in unpaid taxes from 2013. That’s half a million dollars that they need to pay up! This news has left many people wondering how exactly this happened and what repercussions will follow.

The former Hollywood power couple was once regarded as one of the most influential couples in entertainment. Together, they’ve sold millions of albums and starred in some of the biggest movies around. But it looks like their luck may have finally run out when it comes to evading Uncle Sam.

Despite all the success achieved by Robin Thicke and Paula Patton over the years, there is still an enormous debt looming over them which must be settled with the Internal Revenue Service (IRS). In this article, we’ll take a deeper look into why this occurred and what lies ahead for them now that they’re on the hook for such a significant amount of money.

Details Of Tax Debt

Robin Thicke and Paula Patton, the former couple known for their high-profile marriage, have recently been revealed to owe half a million dollars in back taxes. The debt was discovered when the Internal Revenue Service (IRS) conducted an audit on their finances last year.

The IRS confirmed that the duo failed to pay taxes for income earned between 2013 and 2016. During this period, Thicke released three albums, including his number one hit single ‘Blurred Lines’, while Patton made several appearances in movies such as Mission Impossible: Ghost Protocol and Warcraft. Their total tax debt is estimated at $494,000 – almost double what they paid in 2015.

Though it’s unclear why Thicke and Patton didn’t pay their taxes during this time, circumstances like divorce or job loss can lead to unpaid taxes due to financial hardship. Regardless of the reason behind the unpaid taxes, they are now obligated to repay the full amount owed within a certain timeframe set by the IRS.

Consequences Of Unpaid Taxes

The consequences of failing to pay taxes can be serious. When taxpayers are unable to settle their tax debt, the IRS may levy a “failure-to-pay” penalty which is 0.5% per month on unpaid balances. Additionally, the IRS has the authority to seize and liquidate assets in order to satisfy the unpaid balance. This could include items such as cars, real estate properties, or bank accounts.

Additionally, failure to pay taxes can also lead to criminal charges being filed against an individual if they intentionally evade paying taxes owed. In this case, individuals may face fines or even imprisonment for up to five years depending on the severity of their actions. With that said, any taxpayer who finds themselves in Thicke and Patton’s situation should contact a qualified professional early on so that they can work out a payment plan with the government before things get worse.

It’s important for people who owe back taxes to take action immediately in order to avoid financial penalties and other legal repercussions that could follow from neglecting their obligations. Timely resolution of tax debts is essential in order for taxpayers to stay compliant with federal laws and regulations set forth by the IRS.

Conclusion

In conclusion, Robin Thicke and Paula Patton owe the IRS half a million dollars. Unfortunately, this debt can have serious consequences if it isn’t paid off quickly. If they don’t take care of their tax bill in time, they could face hefty fines from the government or even jail time. Additionally, their credit score could be detrimentally affected for years to come.

It’s clear that this kind of debt should not be taken lightly. We all need to remember our responsibility when it comes to taxes, and make sure we pay them on time and in full every year. It’s the only way to avoid facing these kinds of financial crises.

At the end of the day, it is important to keep track of your finances and always stay up-to-date with what you owe – especially when dealing with large amounts like this one owed by Robin Thicke and Paula Patton. The consequences are too great otherwise!

Since 2005, Singersroom has been the voice of R&B around the world. Connect with us via social media below.